DECODING BUDGET 2023 FOR STARTUPS

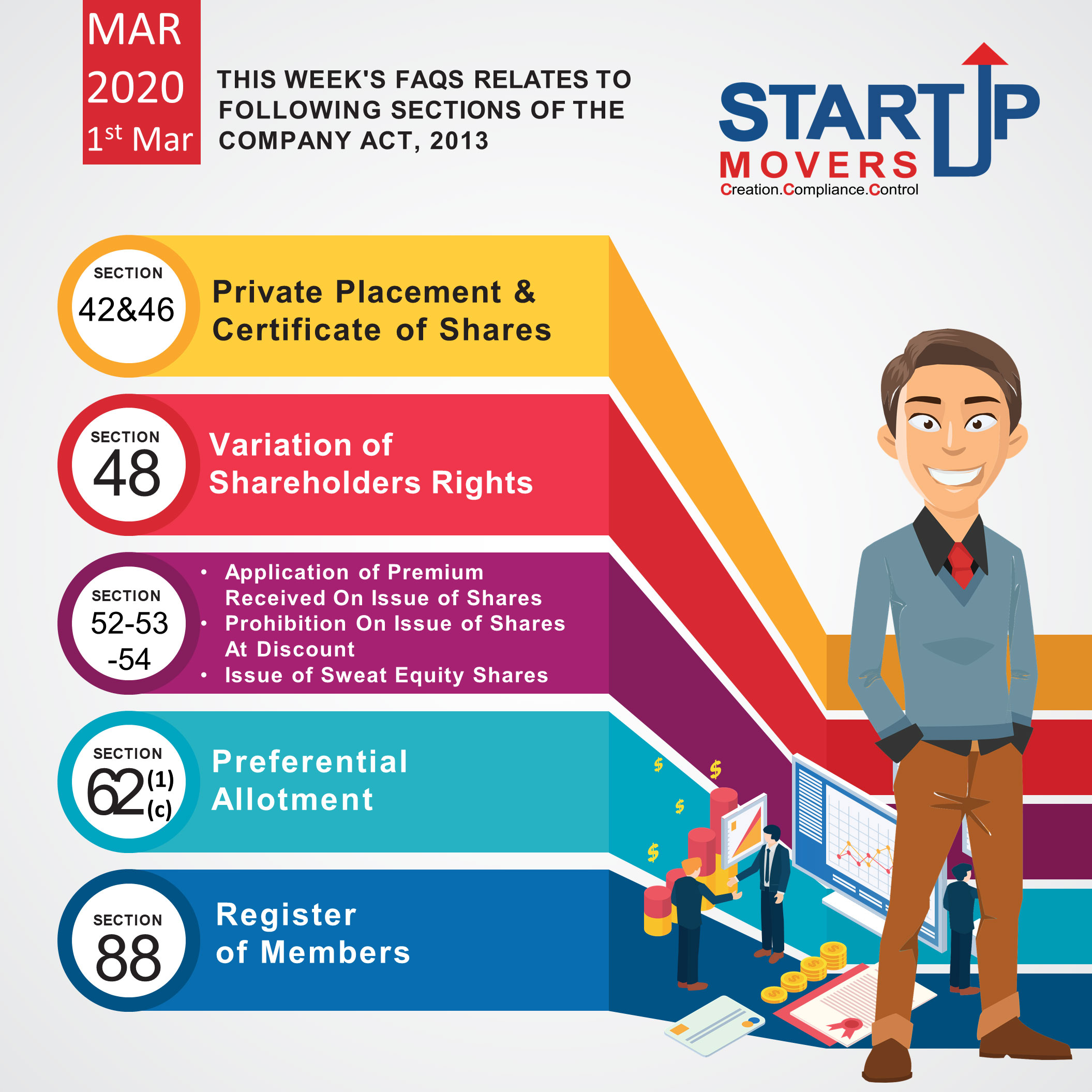

This week’s FAQs relates to following sections of the Company Act, 2013:

Following are the FAQs and their answers:

1. For how many days a private placement offer can be opened?

Ans: According to section 42 of the Companies Act, 2013, there is no minimum time period for Private Placement offer letter however Special Resolution passed under this section is valid for 12 months therefore one can opine that private placement offer can be opened for period of 12 months.

2. A company passed special resolution and issued offer letter in PAS-4 without filing MGT-14, allowed or not?

Ans: No, It is not allowed.

As per Rule 14(8) of the Companies (Prospectus and Allotment of Securities) Rules, 2014, Company shall

issue private placement offer cum application letter only after the special resolution is filed with the

Registrar in form MGT-14.

3. Can a company issue general offer letter in PAS-4?

Ans: No, Private placement offer letter in form PAS-4 can be given only to identified investors only

4. Company wants to issue Compulsory Convertible Debenture, what are the sections will apply on it?

Ans: Section 42 and Section 71 of the Companies Act, 2013 will apply on the issue of Compulsory Convertible debenture.

5. Is PAN number is mandatory while submitting list of allottee in form PAS-3?

Ans: yes

As per rule 14(4) of the Companies (Prospectus and Allotment of Securities) Rule, 2014, it is mandatory to mention PAN of allottee in List of Allottee.

6. Difference between section 42 and section 62(1)(c) of the Companies Act, 2013

Ans: The difference between section 42 and section 62(1)(c) is:

7. Under section 42 of the Companies Act, 2013, within how much time company is required to allot shares.

Ans: A company making offer or invitation under this section shall allot its securities within 60 days from the date of receipt of the application money for the said securities.

8. Within how much time a company is required to file return of allotment under section 42 of the Companies Act, 2013?

Ans: A company is required to file E-Forms PAS-3 (Return of allotment) to the registrar within 15 days of allotment.

9. What is the minimum investment size in case of private placement under section 42 of the Companies Act, 2013

Ans: There is no minimum investment size in case of private placement under section 42 of the Companies Act, 2013.

10. What is the validity period of special resolution passed under section 42 of the Companies Act, 2013?

Ans: Special resolution passed under section 42 is valid for a period of 12 months and if private placement is not completed within the said period then company is required to further pass special resolution to complete the private placement.

11. Common seal has been made optional in Companies Act, 2013, but company has requirement in its Article of Association, now while issuance of share certificates, is it mandatory to affix or not?

Ans: Requirement of common seal is optional in law, but if a company through its Article has mentioned to affix common seal then while issuance of share certificates, it is mandatory to affix seal on it.

12. In case of OPC, how a share certificates will be signed?

Ans: In case of OPC, Share certificates shall be signed by the director of the company and company secretary of the company, where company is required to appoint company secretary, or by a person authorized by the Board of Directors of the company.

13. What is the rate of stamp duty on transfer and issuance of share certificates w.e.f. 9th Jan, 2020?

Ans: Rate of stamp duty:

14. List out four cases in which company may replace all existing certificates by new certificates without required old certificates to be surrendered?

Ans: These are cases in which may replace all of its existing certificates by new certificates without requiring old certificates to be surrendered:

15. How the company will issue share certificates for sweat equity shares?

Ans: There shall be written in bold on the share certificates issued in case of sweat equity shares that the shares contained therein are subject to a lock in period of 3 years.

16. A company wants to do variation in rights of CCPS but no such provision is been given in the AOA of the company? Can company do so?

Ans: Yes

Company can vary the rights attached to its CCPS subject to that the variation is not restricted by the terms of the issue of the said CCPS.

17. A company wants to vary the rights attached to its preference shares (10000 Preference shares of Rs. 10/- each) hold by 8 persons and company decided to take their consent in writing without calling their separate meeting. Specify how much holders carrying such shares consent is required, so that provisions of section 48 of the companies Act, 2013 has complied?

Ans: Consent of preference shareholders holding atleast 7500 of shares is required.

18. A company has taken consent of its preference shareholders for varying their rights (10000 Preference shares of Rs. 10/- each). Thereafter

Is X, Y and Z is eligible to file application under section 48 of the Companies Act, 2013 to make application to NCLT?

Ans: According to section 48 of the Companies Act, 2013, persons holding atleast one tenth of the issued share of that class and voted not in favour of the resolution are eligible to apply to NCLT. In this situation,Z is not eligible as he had voted in favour of the resolution, remaining two X and Y together holds less than one tenth of issued share of that class. So they are not eligible to make application to NCLT.

19. Can securities premium amount be used to make partly paid up shares fully paid up before issuing bonus shares which is also a condition for bonus issue under section 63 of the Companies Act, 2013?

Ans: No

According to section 52 of the Companies Act, 2013, Company can issue fully paid up bonus shares by using its securities premium amount.

20. If company uses the securities premium amount to make partly paid up shares fully paid up, Can it be considered as reduction of share capital under section 66 of the Companies Act, 2013?

Ans: If company uses the amount of securities premium for purpose other than those mention in section 52 of t the Companies Act, 2013, then it will be considered as reduction of share capital under section 66 of the Companies Act, 2013.

21. Can a securities premium amount be used for reduction in share capital?

Ans: Yes

According to section 52 of the Companies Act, 2013, if a company uses securities premium amount for Buy-Back of its own securities, Buy-back results in reduction of capital but it is not covered under section

66 of the Companies Act, 2013.

22. Can a company issue shares at discount except by way of sweat equity shares or to its creditor as provided in Section 53 of the Companies Act, 2013?

Ans: Yes

As per section 53 of the Companies Act, 2013, a company shall not issue shares at discount of its face value. But it can issue share at discount from its issue price.

23. Can a company sweat equity shares to its advisors under section 54 of the Companies Act,2013?

Ans: NO

24. Is it mandatory to disclose sweat equity details in Board Report and if not done, will it be a contravention of section 134 of the Companies Act, 2013.

Ans: It is mandatory under section 54 of the Companies Act, 2013 to disclose the details of sweat equity shares in the Board report. However If a company fails to do so, it will be considered a contravention of provisions of section 54 of the Companies Act, 2013 and not of section 134 of the Companies Act, 2013.

25. Company wants to issue new class of equity shares to one of the director for providing their patent to the company? Can a company do so?

Ans: No

26. Can a company issue equity shares with differential voting rights to its directors/employees under section 54 of the Companies Act, 2013?

Ans: As per section 43, there are two kinds of equity share capital:

Section 54 of the Companies Act, 2013, the word equity share is used instead of the word equity share with differential rights. So company can issue equity shares of the same class which is already issued as sweat equity shares.

27. Up to what percentage of paid up capital a startup company can issue sweat equity shares?

Ans: A startup company can issue sweat equity shares up to 15% of paid up capital in a year, subject to a maximum of 50% of its paid up capital within five years of its incorporation.

28. Can a startup company issue sweat equity share up to 40% of the paid up capital of the company within a period of five years from its incorporation?

Ans: yes

29. What is the treatment of sweat equity shares issued to the manager under section 54 of the Companies Act, 2013?

Ans:Shares issued to the manager under section 54 of the Companies Act, 2013, shall be treated as managerial remuneration under section 197 and 198 of the Companies Act, 2013.

30. Is it mandatory to get valuation report for shares upon conversion of securities at time of issuance

of those convertible securities?

Ans:No.

Valuation can be done at the time when the offer of convertible securities is made

or

At the time, which shall not be earlier than 30 days to the date when the holders of convertible security becomes entitled to apply for shares.

31. In which case, index of names under section 88 of the Companies Act, 2013 is not required to be maintained by the Company?

Ans: If the number of member is less than 50, company is not required to maintain index of names.

32. Purpose of Form SH-3?

Ans: Company is required to maintain register containing details of sweat equity shares in Form SH-3.

33. Within how much time a company is required to give intimation to the ROC with regard to the change in the place of foreign register.

Ans: A company is required to file Form MGT-3 with 30 days from the date of change in the place of foreign register.

34. Within how much time a company is required to make entry in the registers maintained under section 88 of the Companies Act, 2013?

Ans:The entries in the register maintained under section 88 of the Companies Act, 2013 shall be made within seven days after the Board approves the allotment or transfer of shares.

35. For how much time company is required to preserve all books and other docs related to the share certificate including blank form of share certificate?

Ans: All books and other docs relating to share certificate shall be preserved in good order for not less than thirty years.

A startup company can issue sweat equity up to 50% of the paid up capital within a period of five years from the date of its incorporation.

36. Compliances required to be done by the company for changing the location of statutory registers of the company?

Ans:Company is required to pass special resolution for changing the location of its register of members within the city, town or village in which the registered office is situated or any other place in India in which more than one-tenth of the total members entered in the register of member reside.

Our team of experts can help you in various company law matter. You can reach out to us via Email: info@startup-movers.com, Call: 9953247264, Whatsapp: 9953247264.