Understanding the value behind the numbers!

Valuation Advisory Services provide businesses with an expert evaluation of their financial worth by analyzing assets, liabilities, and future growth potential. These services help companies make informed decisions on strategic planning, fundraising, M&A, and compliance, ensuring they understand their true market value.

See why valuation matters more than ever – Unlocking growth and securing investments

Valuations are critical for fair deals as M&As surge, ensuring accurate assessments.

Regular valuations help companies navigate economic uncertainties.

Growing recognition of intangible assets drives demand for comprehensive valuations.

Startups need precise valuations to attract investors and secure capital.

Valuations ensure businesses meet tax and financial reporting standards.

As ESOPs grow, accurate valuations ensure fair stock distribution and tax compliance.

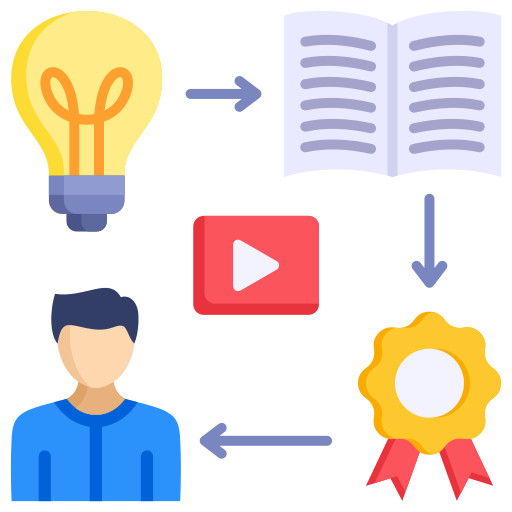

Follow our easy steps for a seamless valuation experience!

Complete Valuation Form

Submit Required Documents

Define Valuation Purpose

Review Method and Fees

Receive Valuation Report

Know the crucial valuation compliance guidelines for your business

Mandates valuation for transactions like mergers, demergers, and share transfers under Section 247.

Requires asset valuation for capital gains tax and determining fair market value for unlisted shares.

Under FEMA, valuation for foreign investment transactions using DCF for unlisted shares.

Requires asset and liability valuation for creating fair resolution plans during insolvency proceedings.

Requires valuation for financial reporting to ensure accurate presentation of assets and liabilities.

Enforces valuation in listed companies for securities issuance, takeovers, and delisting offers.

Reliable valuations, expertly delivered every time

Unlock the right valuation methods for your business

Trust Startup Movers for a seamless valuation advisory experience

10+ years of experience with 80+ experts guiding you every step of the way.

All-inclusive pricing with no hidden fees.

Get your Share Purchase Agreement designed efficiently and on time.

From documents to compliance, we handle it all.

Join a large community of successful businesses.

We’ve helped startups grow into billion-dollar businesses.

Explore full potential with our comprehensive valuation expertise

Discover why businesses love working with Startup Movers!

Really happy with the professional way in which the work has been done (y). Worked with other CA’s previously, Startup movers were the best one- whom we worked with

Excellent service at affordable prices. They are very punctual and work really hard to get the job done.

These guys are really good particularly their secretarial part. Very professional very prompt.

Excellent!!…. Excellent!..

Startup Movers helped us with our

company incorporation & re-correction was done quickly and everything that goes with it has done

good.

The best part about working with StartUp Movers is that they understand the DNA of a startup very well, and are flexible in their approach. This makes them very compatible partners for any start-up.

I have had great experience with Shivani. Right now the only structured department in my organisation is Finance, grateful to the team of startup movers.

These guys are very professional and perfect in their areas of expertise. They know their customers’ pain point very well. From company registration to compliances, they have delivered the best. For an early stage startup, these guys act as a “Virtual CFO”.

Working with the Startup Movers team has been extremely great in all aspects. These guys are the best at the best affordable prices in the market.

We wanted to setup employee benefit plans such as ESOP for our startup and startup movers team were the perfect fit to do those policy drafting and helping with the correct statutory filing. They have framed the policy as a perfect fit for our requirement and in very timely manner.

Since the start of my entrepreneurship journey, Start-up Movers have been managing our Secretarial Compliance (including fundraising compliances), and financial compliance (such as GST, TDS, PF/ ESI, PT) The team has been phenomenal. They are well-versed with all MCA rules and regulations.

Your concerns matter: Explore our FAQs for guidance!

Company valuation for startups refers to the process of determining the economic value of a startup company.

This involves assessing key factors such as market potential, revenue models, intellectual property, and the experience of the founding team.

It helps investors, founders, and other stakeholders make informed decisions regarding investments, funding, and growth strategies.

A professional valuation ensures that businesses have an accurate assessment of their worth, which is vital during key financial transactions like mergers, acquisitions, or fundraising.

It provides transparency to stakeholders and helps business owners make decisions about their company’s future with confidence. Accurate valuations also help in identifying strengths and areas for improvement, supporting long-term growth strategies.

When determining the value of a startup with limited financial history, experts often use methods that focus on future potential rather than past performance.

Techniques like the Risk Factor Summation method or the Scorecard Valuation Method account for the startup’s industry, team, and growth prospects.

Additionally, projected revenue, market opportunity, and product innovation are key factors that can drive a startup's valuation, helping investors gauge its long-term viability.

Financial advisory plays a critical role in business valuation by offering strategic insights that influence the valuation process.

Advisors help companies understand their financial performance, optimize operational efficiency, and assess the risks involved in investment decisions.

This combined perspective ensures that business valuations are grounded in accurate financial data and market realities, helping business owners make better decisions.

Experts ensure accuracy by using a combination of established valuation methodologies, such as discounted cash flow analysis, comparable company analysis, and asset-based approaches.

They also conduct a thorough review of the company’s financials, industry trends, and market conditions.

Experienced consultants apply the most relevant approach based on the company’s nature and goals, ensuring precise and reliable results.

Valuing a startup involves assessing factors such as its market potential, revenue models, intellectual property, growth rate, and the experience of its founding team.

Since startups often lack extensive financial history, experts focus on forward-looking indicators like projected revenue, customer acquisition cost, and scalability to estimate its current and future value.