Safeguard your equity from hidden risks!

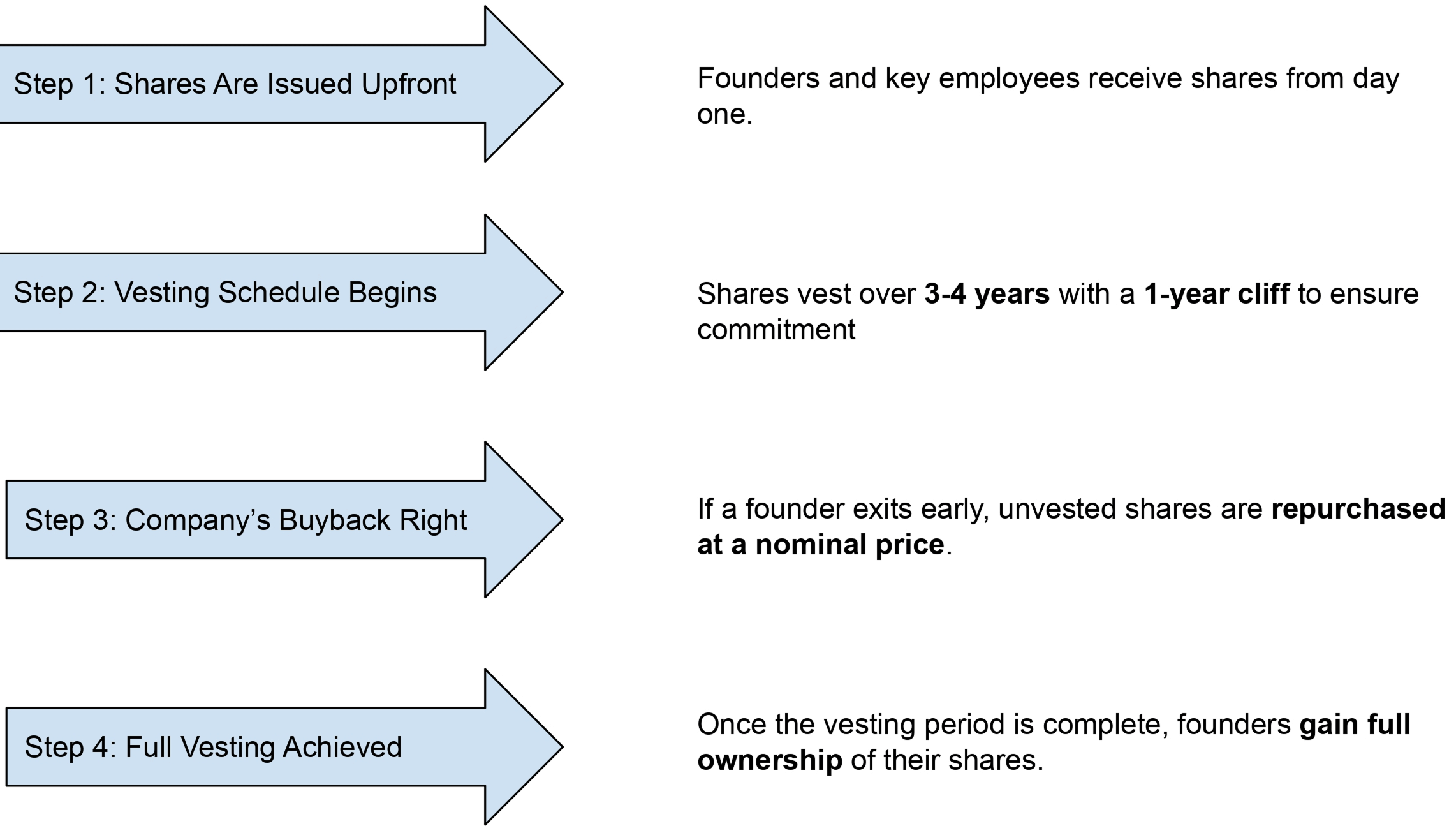

Reverse vesting is a mechanism used in startup equity agreements where founders or key employees receive shares upfront but must "earn" them over time by staying with the company.

If they leave early, the company or the remaining founders has the right to buy back the unvested shares at a nominal price.

Why Reverse Vesting is a game-changer for startups!

Encourages founders to stay invested in the company’s success.

Protects against a situation where inactive founders hold significant stakes.

Stops inactive founders from holding large stakes and blocking decisions.

Attracts investors by securing equity against premature exits.

Ensures that key employees contribute long-term before gaining full ownership.

Allows the company to reclaim and reallocate unvested shares efficiently.

Simplify reverse vesting with our hassle-free process!

Connect with Experts

Submit Required Documents

In-Depth Analysis & Structuring

Review and Finalize Agreement

Lock And Implement

Complete your reverse vesting process with the right paperwork!

Step-by-step guide to the Reverse Vesting process

Know what works best for you?

| Feature | Reverse Vesting | Regular Vesting |

|---|---|---|

| Equity Distribution | Shares granted upfront but vest over time | Shares are granted over time |

| Equity Distribution | Company can buy back unvested shares | Shares are granted over time |

| Risk Protection | Company can buy back unvested shares | No buyback option for the company |

| Control & Security | Safeguards company equity from premature exits | No such protection, equity remains with the individual |

| Common Use Case | Founders & key executives | Employees & advisors |

Trust Startup Movers for hassle-free Reverse Vesting!

10+ years of experience with 80+ experts guiding you every step of the way.

All-inclusive pricing with no hidden fees.

Streamline Your Reverse Vesting Process with Experts!

From documents to compliance, we handle it all.

Join a large community of successful businesses.

We’ve helped startups grow into billion-dollar businesses.

Discover why businesses love working with Startup Movers!

Really happy with the professional way in which the work has been done (y). Worked with other CA’s previously, Startup movers were the best one- whom we worked with

Excellent service at affordable prices. They are very punctual and work really hard to get the job done.

These guys are really good particularly their secretarial part. Very professional very prompt.

Excellent!!…. Excellent!..

Startup Movers helped us with our

company incorporation & re-correction was done quickly and everything that goes with it has done

good.

The best part about working with StartUp Movers is that they understand the DNA of a startup very well, and are flexible in their approach. This makes them very compatible partners for any start-up.

I have had great experience with Shivani. Right now the only structured department in my organisation is Finance, grateful to the team of startup movers.

These guys are very professional and perfect in their areas of expertise. They know their customers’ pain point very well. From company registration to compliances, they have delivered the best. For an early stage startup, these guys act as a “Virtual CFO”.

Working with the Startup Movers team has been extremely great in all aspects. These guys are the best at the best affordable prices in the market.

We wanted to setup employee benefit plans such as ESOP for our startup and startup movers team were the perfect fit to do those policy drafting and helping with the correct statutory filing. They have framed the policy as a perfect fit for our requirement and in very timely manner.

Since the start of my entrepreneurship journey, Start-up Movers have been managing our Secretarial Compliance (including fundraising compliances), and financial compliance (such as GST, TDS, PF/ ESI, PT) The team has been phenomenal. They are well-versed with all MCA rules and regulations.

Your concerns matter: Explore our FAQs for guidance!

A reverse vesting order is a legal agreement that dictates how founders or key executives earn their shares over time.

While shares are issued upfront, the company retains the right to buy back unvested shares if the individual leaves before the reverse vesting schedule is complete.

Key clauses in a reverse vesting agreement include:

TA reverse vesting schedule ensures that founders remain committed to the startup while protecting investors from premature exits.

It prevents inactive founders from holding equity unfairly and helps maintain team stability.

Unlike traditional vesting, where shares are granted over time, reverse vesting provides shares upfront but requires founders to earn them back through continued involvement in the company.

If they leave early, unvested shares are reclaimed by the company.