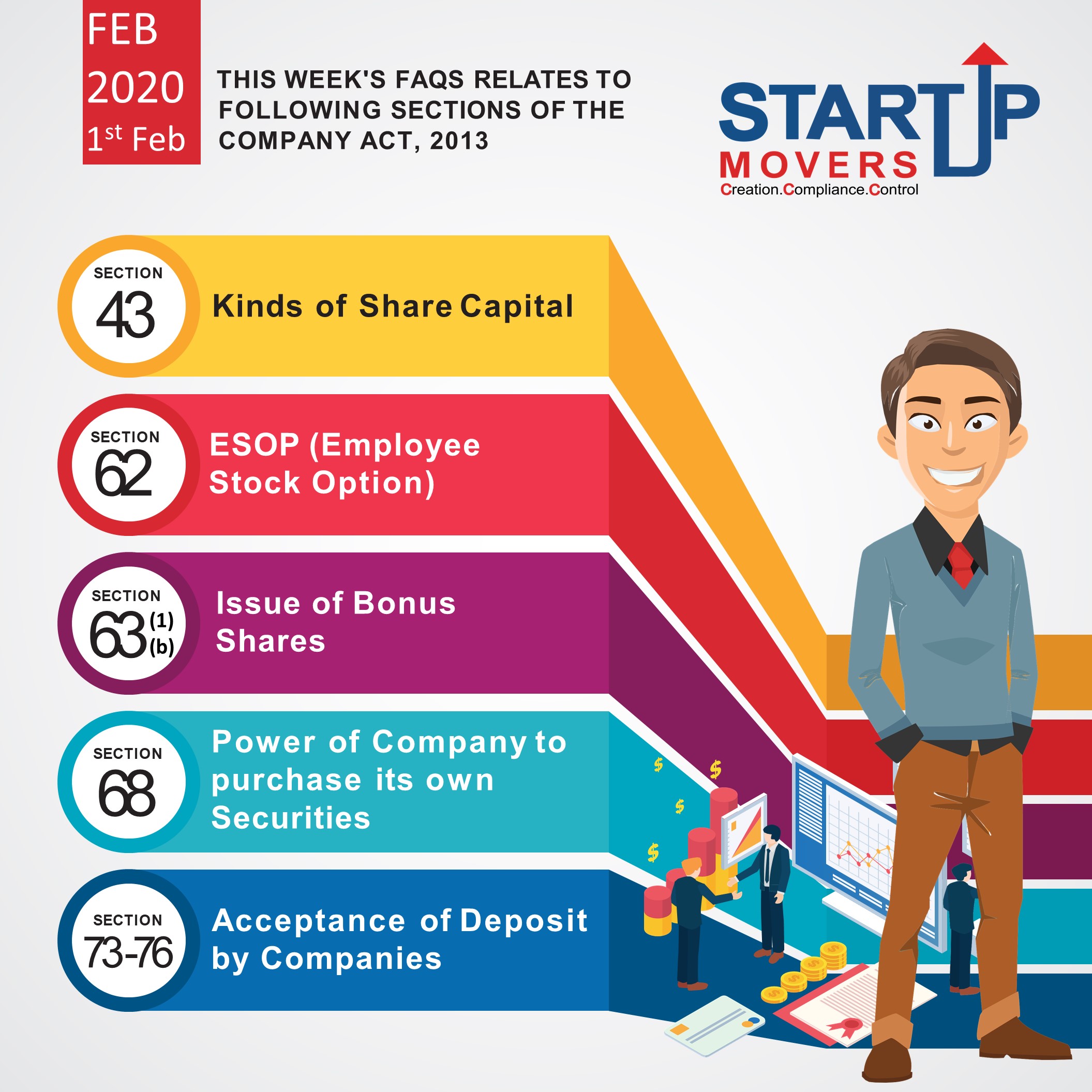

COMPANIES ACT 2013 - FEB 2020 FAQ

This Month's FAQs relates to following sections of the Company Act, 2013:

- Section 43: Kinds of Share Capital

- Section 62(1)(b): ESOP (Employee Stock Option)

- Section 63: Issue of Bonus Shares

- Section 68: Power of Company to purchase its own Securities

- Section 73 to 76: Acceptance of Deposit by Companies

Following are the FAQs and their answers:

- Company has not filed financials and annual return for the F.Y 2018-19, can company is eligible to issue equity shares with differential voting right in F.Y 2019-20?

- Yes, Company is eligible to issue equity shares with differential voting right in F.Y 2019-20.

- As per rule 4 of the Companies (Share Capital and Debenture) Rules, 2014, restricts company for issuing equity shares with differential voting rights, if company fails to file financial statements and annual return for three financial years immediately preceding the financial year in which it is decided to issue such shares.

- Company fails to disclose the details of issue of equity shares with differential voting rights in the Board report, will it be treated as contravention of section 134?

- No, it will be treated as default under section 43 but it shall not be a default of section 134.

- Upto what percent a DVR (Differential Voting Right) carry voting right of the total voting right of the company?

- The voting power in respect of shares with differential rights of the company shall not exceed 74% of total voting power including voting power in respect of equity shares with differential rights issued at any point of time.

- After how much time a company can issue equity share with differential voting right after making good default of payment of debenture?

- After 5 years.

- Is director of the company is eligible for ESOP under Companies Act, 2013?

- Yes, in the following two cases director is eligible for ESOP:

- If a director who either himself or through his relative or through any Body Corporate, directly or indirectly, holds less than 10% of the outstanding equity shares of the company.

- In case of Startup Company, director is eligible for ESOP upto five year from the date on incorporation of the company.

- What is the minimum period prescribed under Companies Act, 2013 in between the grant of option and vesting of option?

- There shall be a minimum period of one year between the grant of option and vesting of option. Company cannot decrease that period of one year.

- Under ESOP Scheme, can a company fix a lock-in-period of 4 years after allotment of shares to the employees?

- Yes, Company shall have the freedom to specify the lock-in-period for the shares issued pursuant to the exercise of option.

- A company has fixed the period of one year to exercise option, under the ESOP Scheme, can company reduce this period later by passing Ordinary resolution?

- No

- Reason: A company cannot change terms of ESOP which are prejudicial to the interest of option holders.

- Is independent director eligible for ESOP?

- No

- Can an employee pledge or hypothecate options granted under ESOP Scheme?

- No

- Employee can pledge or hypothecate shares after exercise of options vested subject to terms of ESOP scheme.

- Specify the cases in which ordinary resolution or special resolution is required for implementing ESOP by the company?

- In case of private company, Ordinary resolution is required for ESOP while in case of public company, Special resolution is required.

- Can a company issue bonus shares if it is not authorized by its Article of Association?

- As per section 63 of the Companies Act, 2013, a company can issue bonus shares only if it is authorized by the Article of Association of the company.

- Can a company after completion of buyback of equity shares under section 68 issue fresh equity shares upon conversion of CCPS within a period of 4 months?

- Yes,

- According to section 68(8) of the Companies Act, 2013, Company is restricted to issue new shares within a period of 6 months after completion of buy back except by way of bonus issue or in discharge of subsisting obligation such as conversion of warrants, stock option scheme, sweat equity shares or conversion of preference shares or debentures into equity shares.

- Is company eligible to Buy back equity shares from earlier proceeds of issue of equity shares within 25% of paid up capital and free reserve by passing special resolution?

- No,

- As per section 68, no buy back of any kind of shares or other specified securities shall be made out of the proceeds of an earlier issue of the same kind of shares or same kind of other specified securities.

- What is the purpose of form SH-10?

- Company is required to maintain register of buyback in form SH-10.

- In which form, company is required to file buy back return?

- Company is required to file form SH-11 within 30 days of completion of buy back with the Registrar of company.

- A company XYZ private limited, has not filed its annual return for the F.Y 2018-19, now in F.Y 2019-20 is company eligible to buy back its shares?

- No

- What are the options available for buy back?

- A company may buy back shares:

- From the existing shareholders or security holders on a proportionate basis

- From the open market

- By purchasing the securities issued to the employees if the company pursuant to a scheme of stock option or sweat equity.

- Under what circumstances a company is prohibited to buy back its shares?

- No company shall, directly or indirectly, purchase its own shares or other specified securities in case such company has not complied with the provisions of sections 92, 123, 127 and section 129.

- Company received advance of Rs. 2 lakh on 1st April, 2018 but it is showing outstanding on the books as on 31st March, 2019, will it be considered as deposit or exempted deposits.

- Yes, It shall be considered as deposit.

- Any advance received for supply of goods or for provision of services if not appropriated against supply of goods or services within a period of three hundred and sixty five days from the date of acceptance of such advance, such advance shall be considered as deposit.

- Company receives Rs 1 lakh and issues shares against it worth Rs. 90,000 and a period of 6 month expired but company has not refunded the balance amount of Rs 10,000. Whether such balance amount be considered as deposit or share application money?

- It shall be considered as deposit.

- Any amount which is pending for allotment for more than 6 months, shall be considered as Deposit in the books.

- What percentage of share capital, free reserves and securities premium, a startup company can accept from its members as deposit?

- There is no limit for start-ups to accept money from its members as deposit.

- Can a eligible private company accept deposit having maturity period less than six months?

- yes

- A company for the purpose of meeting any of its short term requirements, accept or renew deposits for repayment earlier than six months from the date of deposit, subject to following conditions:

- Such deposits shall not exceed 10% of (paid up capital + free reserves + securities premium) of the company

- Such deposits are repayable not earlier than three months from the date of such deposits or renewal thereof

- How much amount a company can receive from its employee which shall not be considered as deposit?

- Upto his annual salary.

- Within how much time a company is required to pay existing deposits after the commencement of Companies Act, 2013?

- Within 3 years.

- Within how much time a company is required to give ROC details of existing deposits after commencement of Companies Act, 2013?

- Within 3 months.

NOTE: Our team of experts can help you in various company law matter. You can reach out to us via Email: info@startup-movers.com, Call: 9953247264, What’s app: 9953247264.