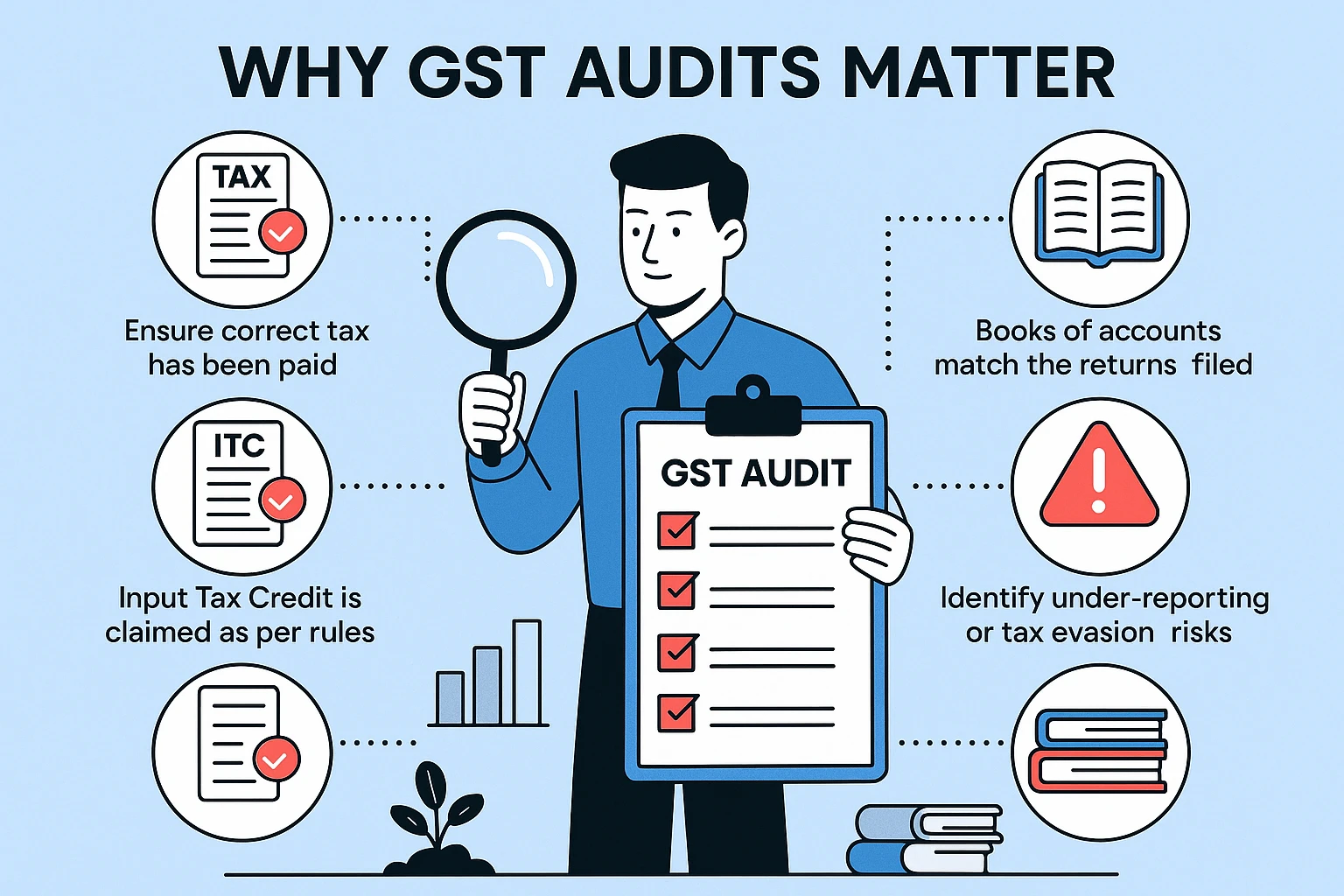

An Audit under GST is a detailed examination of a registered taxpayer’s records, returns, and documents to verify the accuracy of GST compliance

The purpose is to ensure that the tax liability is correctly declared and paid, and that Input Tax Credit (ITC) has been claimed in accordance with the law.

Whether it’s turnover or tax triggers, here’s who needs to stay audit-ready

Self-Certify From GSTR-9C annually

The Department can audit regardless of size

Small businesses can also face scrutiny

Whether or not you're mandated for a GST Audit, voluntary internal reviews can save you from painful surprises and we’re here to make sure they never arrive. Contact us now »

Explore the core goals of a GST audit

Learn why early audits lead to fewer notices, cleaner books, and smarter decisions.

Minimize the risk of late fees, interest, and GST notices by fixing ITC errors before they snowball.

Ensure vendor compliance, accurate GSTR-2B reconciliation, and maximize eligible ITC with clean records.

Detect mismatches, underreporting, and tax misclassifications early especially in high-risk sectors.

Build a solid paper trail and return structure that’s ready for scrutiny at any time.

Know your compliance obligations based on turnover and ensure you're not caught off-guard.

Tighten your compliance systems and reporting processes to avoid future errors and financial impact.

From review to reporting, we simplify every step of your GST audit.

Tell Us Your GST Set Up

Get a Quick Risk Assessment

Submit Docs For Review

Get Your Audit-Ready Report

Here’s what you need to keep your GST Audit smooth and penalty-free.

From departmental to special audits, here’s what you need to be prepared for.

Explore our complete suite of GST Audit

Turnover-Based GST Audit Review

Departmental Audit Support (Section 65)

Reconciliation Services

Special Audit Assistance (Section 66)

Input Tax Credit (ITC) Analysis

Compliance Check & Documentation Review

Prevention of Show Cause Notices (SCNs)

Filing & Certification Support

Internal GST Audit (Voluntary)

Internal Controls & SOP Review

We audit smarter, not harder with precision, process, and proactive control.

Step 1:

Step 1:We begin by assessing your business model, returns filed, and GST structure to spot audit triggers early

Step 2:

Step 2:We run detailed GSTR-1, 3B, and 2B checks to find mismatches and hidden risks in your data.

Step 3:

Step 3:From invoices to contracts and ledgers — we cross-check every document against your returns.

Step 4:

Step 4:You get a clear audit risk report and practical recommendations to plug compliance gaps.

Step 5:

Step 5:Whether it's audit scrutiny, notice response, or SCN handling, we’ve got your back.

Step 6:

Step 6:We don’t stop at one-time audits. Our ongoing reviews help you stay clean, clear, and penalty-proof.

Understand how audit lapses can lead to penalties, blocked ITC, and recurring departmental scrutiny.

Failure to comply may attract a general penalty of up to ₹25,000 under Section 125.

Non-compliance can trigger deeper reviews or investigative audits by the GST department.

Audit discrepancies may lead to Show Cause Notices and delay your future GST refunds.

Misreported or unpaid tax attracts interest, worsening financial strain over time.

GST officers may block your Input Tax Credit until mismatches are resolved

Repeated audits affect your credibility and invite continuous compliance pressure.

Count on Startup Movers as your trusted GST Partner!

10+ years of experience with 125+ experts guiding you every step of the way.

All-inclusive pricing with no hidden fees.

Using tech to provide great service to customers everywhere.

From documents to compliance, we handle it all.

Join a large community of successful businesses.

We’ve helped startups grow into billion-dollar businesses.

Discover why businesses love working with Startup Movers!

Really happy with the professional way in which the work has been done (y). Worked with other CA’s previously, Startup movers were the best one- whom we worked with

Excellent service at affordable prices. They are very punctual and work really hard to get the job done.

These guys are really good particularly their secretarial part. Very professional very prompt.

Excellent!!…. Excellent!..

Startup Movers helped us with our

company incorporation & re-correction was done quickly and everything that goes with it has done

good.

The best part about working with StartUp Movers is that they understand the DNA of a startup very well, and are flexible in their approach. This makes them very compatible partners for any start-up.

I have had great experience with Shivani. Right now the only structured department in my organisation is Finance, grateful to the team of startup movers.

These guys are very professional and perfect in their areas of expertise. They know their customers’ pain point very well. From company registration to compliances, they have delivered the best. For an early stage startup, these guys act as a “Virtual CFO”.

Working with the Startup Movers team has been extremely great in all aspects. These guys are the best at the best affordable prices in the market.

We wanted to setup employee benefit plans such as ESOP for our startup and startup movers team were the perfect fit to do those policy drafting and helping with the correct statutory filing. They have framed the policy as a perfect fit for our requirement and in very timely manner.

Since the start of my entrepreneurship journey, Start-up Movers have been managing our Secretarial Compliance (including fundraising compliances), and financial compliance (such as GST, TDS, PF/ ESI, PT) The team has been phenomenal. They are well-versed with all MCA rules and regulations.

Get answers to common questions on GST Advisory and Transaction Structuring services

A GST Audit is a detailed review and examination of a taxpayer’s GST records to ensure that all tax filings, input tax credit claims, and payments are accurate and fully compliant with the GST law.

From FY 2020–21 onwards, the mandatory GST audit by a Chartered Accountant or Cost Accountant has been removed having turnover more than ₹2 crore in a financial year.

There are mainly three types:

Different sectors face unique GST challenges. We help analyze GST impact for industries like real estate, e-commerce, and exports to ensure compliance and profitability.

A departmental GST audit must be completed within 3 months from the date of commencement (extendable to 6 months).

Startup Movers assists in preparing for this timeline and responding effectively.

To prepare for a GST audit, ensure all GST returns are filed correctly, books of accounts are updated, and invoices, ITC records, and reconciliations (like GSTR-3B vs GSTR-1 and GSTR-2A/2B) are in order.

Keep all supporting documents ready for verification.

If the GST auditor finds discrepancies, the business may face:

Startup Movers helps address these with expert representation and corrections.

No, GST audit is not mandatory for all businesses. While the turnover-based audit requirement (for businesses having turnover above ₹2 crore) was withdrawn, departmental audits under Section 65 and special audits under Section 66 can still be initiated for any registered taxpayer if discrepancies are found.

However, Self-Certification by the taxpayer in Form GSTR-9C is mandatory for businesses having turnover greater than ₹5 crore.

That’s why many businesses opt for voluntary internal control reviews to stay compliant and audit-ready.