Unlock benefits, avoid penalties, and stay legally compliant with a valid GSTIN.

Registering under GST gives your business a formal identity, essential for operating legally, opening bank accounts, and maintaining credibility.

With a valid GSTIN, you can issue GST-compliant invoices and lawfully collect GST from your clients or customers.

GST registration allows you to claim credit for taxes paid on purchases, reducing your overall tax burden and increasing profitability.

Planning to go pan-India or sell via Amazon, Flipkart, Meesho, etc.? GST registration is mandatory for e-commerce operations and interstate trade.

Public tenders and institutional investors often require GST-registered businesses. It’s a compliance badge that unlocks trust and funding.

GST registration signals professionalism and transparency, making it easier to onboard corporate clients, collaborate with vendors, and close bigger deals confidently.

We’ve made GST registration easy to understand and even easier to complete.

Speak to Our GST Experts

Document Collection & Preparation

Filing Application Online

Responding to Notices

GSTIN Number Issued

Keep these documents ready for a smooth and speedy GST registration process.

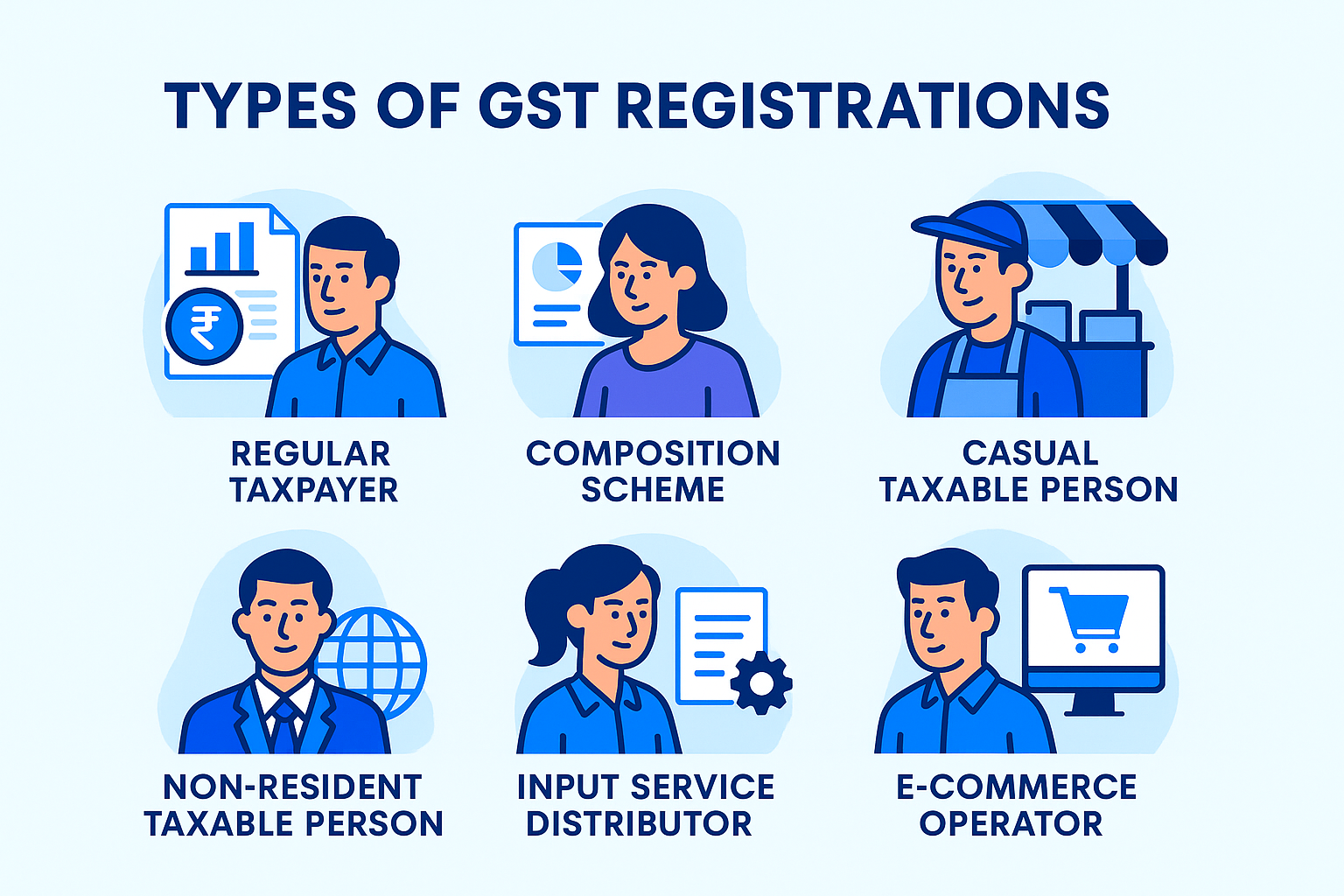

Explore the different GST registration types applicable to your business.

| GST Registration Type | Who Should Apply | Key Features / Purpose | Mandatory Criteria | Applicable Form |

|---|---|---|---|---|

| Regular Taxpayer | Businesses with turnover above ₹40L (goods) / ₹20L (services) | Standard GST compliance with ITC benefits and return filing | Turnover threshold or voluntary registration | REG-01 |

| Composition Scheme | Small manufacturers, traders, or restaurants with turnover up to ₹1.5 crore | Lower tax rates, simple quarterly returns, no ITC | Voluntary for eligible taxpayers | REG-01 + CMP-02 |

| Casual Taxable Person | Businesses operating occasionally (e.g., exhibitions, fairs, stalls) | Temporary GST registration valid for 90 days, with advance tax payment | No fixed place of business in a taxable state | REG-01 |

| Non-Resident Taxable Person | Foreign businesses supplying goods/services in India without physical presence | Temporary registration, tax payable in advance | Non-resident with occasional taxable supplies | REG-09 |

| Input Service Distributor (ISD) | Head offices distributing input tax credit across multiple branches | Centralised credit distribution among units sharing PAN | Must invoice and distribute ITC proportionately | REG-01 |

| TDS Deductor | Government departments, PSUs, or notified entities deducting GST at source | File GSTR-7 and deposit deducted TDS | Section 51 of CGST Act | REG-07 |

| TCS Collector (E-Commerce Operator) | Platforms collecting tax at source on behalf of sellers (e.g., Amazon, Swiggy) | File GSTR-8 and remit TCS collected | Section 52 of CGST Act | REG-07 |

| UIN Holders | Embassies, UN bodies, foreign diplomatic missions | Can claim refund on inward GST paid | Must apply for Unique Identity Number | REG-13 |

| Non-Resident Online Services Provider (OIDAR) | Foreign digital service providers (e.g., software, cloud, ads) selling to Indians | GST registration mandatory to pay tax on online services | Only if recipient is non-registered Indian resident | REG-10 |

| Supplier via E-Commerce | Any seller selling goods/services via e-commerce platforms | Mandatory registration even below threshold | Inter-state or platform-based supply | REG-01 |

We help you choose and apply for the correct GST registration—fast, accurate, and fully compliant.

Once you’re registered, we become your go-to GST compliance partner

Every step. Every form. One expert team to guide your GST journey.

We assess your business model, turnover, and goals to recommend the right GST registration type, no guesswork.

You get a smart checklist, tailored to your entity type, with clear format rules, and handholding till upload is perfect.

We pre-verify everything, track approvals, and handle departmental queries or REG-03 notices; before you even know they came.

You’ll know exactly where your GSTIN stands; no chasing, no surprises.

From getting your GSTIN certificate to setting up your login credentials, e-way bill access, and first-time compliance calendar

With us, you get expert support, not just automated systems. We’re here whenever you need us.

Affordable pricing for hassle-free GST registration

Our Service Fee:

End-to-end support

Count on Startup Movers as your trusted GST Partner!

10+ years of experience with 80+ experts guiding you every step of the way.

All-inclusive pricing with no hidden fees.

Get your Share Purchase Agreement designed efficiently and on time.

From documents to compliance, we handle it all.

Join a large community of successful businesses.

We’ve helped startups grow into billion-dollar businesses.

Discover why businesses love working with Startup Movers!

Really happy with the professional way in which the work has been done (y). Worked with other CA’s previously, Startup movers were the best one- whom we worked with

Excellent service at affordable prices. They are very punctual and work really hard to get the job done.

These guys are really good particularly their secretarial part. Very professional very prompt.

Excellent!!…. Excellent!..

Startup Movers helped us with our

company incorporation & re-correction was done quickly and everything that goes with it has done

good.

The best part about working with StartUp Movers is that they understand the DNA of a startup very well, and are flexible in their approach. This makes them very compatible partners for any start-up.

I have had great experience with Shivani. Right now the only structured department in my organisation is Finance, grateful to the team of startup movers.

These guys are very professional and perfect in their areas of expertise. They know their customers’ pain point very well. From company registration to compliances, they have delivered the best. For an early stage startup, these guys act as a “Virtual CFO”.

Working with the Startup Movers team has been extremely great in all aspects. These guys are the best at the best affordable prices in the market.

We wanted to setup employee benefit plans such as ESOP for our startup and startup movers team were the perfect fit to do those policy drafting and helping with the correct statutory filing. They have framed the policy as a perfect fit for our requirement and in very timely manner.

Since the start of my entrepreneurship journey, Start-up Movers have been managing our Secretarial Compliance (including fundraising compliances), and financial compliance (such as GST, TDS, PF/ ESI, PT) The team has been phenomenal. They are well-versed with all MCA rules and regulations.

Need answers? Browse our FAQs for quick guidance!

You must register for GST if your annual aggregate turnover exceeds:

Additionally, GST registration is mandatory regardless of turnover for:

Startup Movers helps you determine the correct threshold and register under the right GST type—no confusion, only compliance.

The process of GST Registration involves:

With Startup Movers, the entire process is handled for you—accurately and on time.

Yes, online GST registration is possible via www.gst.gov.in.

However, errors in selection of type, document format, or incorrect detail submission can lead to rejection. Our experts help you register correctly the first time.

Yes, if your income crosses ₹20 lakh (₹10 lakh for NE states) or you sell via online platforms (e.g., Amazon, Meesho), you must register for GST even if turnover is below the threshold.

Yes, you can apply for cancellation of your GSTIN through the GST portal if your business shuts down or your turnover falls below the threshold. We help manage the entire cancellation process too.

A GSTIN (Goods and Services Tax Identification Number) is a unique 15-digit registration number assigned to every business or individual registered under the GST regime in India.

It is issued by the GST department after successful GST registration and is mandatory for collecting GST, claiming input tax credit, and filing GST returns.

Format of a GSTIN Number:Example: 07ABCDE1234F1Z5

GST Registration cost on the government portal is free.

However, if you're opting for professional assistance (recommended to avoid errors), service providers like us charge a nominal, transparent fee for end-to-end support, document validation, and follow-up.

Once the documents are submitted and verified, you typically receive your GSTIN number within 3–7 working days, depending on department workload and whether clarification is needed.

Failure to register on time can lead to heavy penalties, denial of input tax credit, and even business disruption. Avoid these risks by registering early with expert help.

You can check your GST registration status online through the official GST portal:

Step 1: Visit www.gst.gov.in

Step 2: Go to Services > Registration > Track Application Status

Step 3: Enter your ARN (Application Reference Number) or SRN

Step 4: Click "Search" to view your current status—whether it’s approved, pending, or requires clarification.

If you're registering through Startup Movers, we track and update you at every stage—so you don’t have to worry about logging in repeatedly.