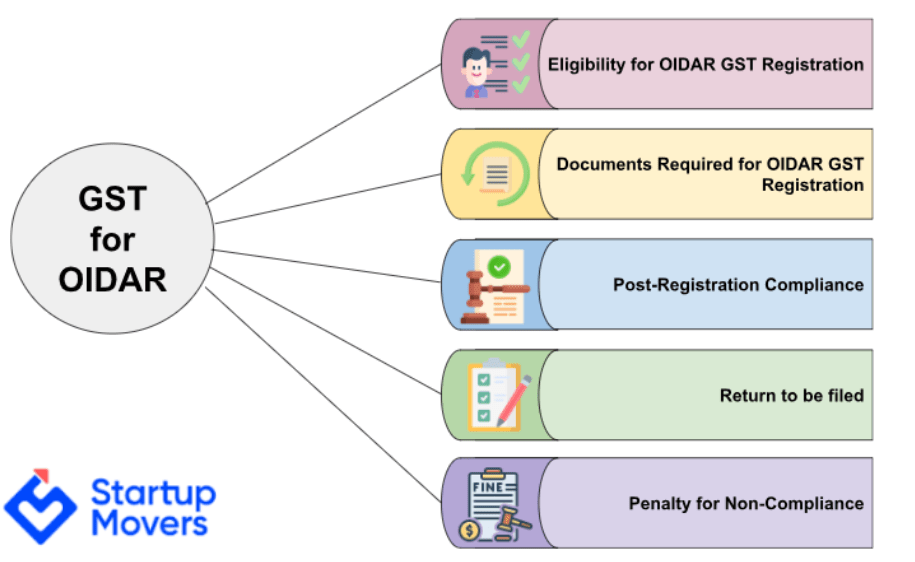

OIDAR stands for Online Information Database Access and Retrieval services. These include services delivered over the internet with minimal or no human intervention

OIDAR services under GST Law refers to digital or electronic services delivered online, such as streaming platforms, SaaS subscriptions, online gaming, and cloud-based services.

Here's why training is non-negotiable

If you're a foreign entity providing online services to India, or an Indian startup using global digital tools, understanding OIDAR GST liability is crucial.

Services provided to GST Registered Indian Entity Taxable under Reverse Charge: Indian Entity will pay GST

Services provided to Unregistered person: Individual, Government, Local Authority, any Indian Entity Taxable under Normal Charge: Foreign entity will pay GST

This page outlines who pays the tax under different scenarios, including B2B, B2C, intermediaries, and reverse charge cases.

| Scenario | Example | Who Pays What | Why |

|---|---|---|---|

| 1. B2C | ABC Plc., a foreign company, offers an online course from the USA to Rahul, an unregistered user in India | ABC Plc.. (foreign OIDAR provider) pays IGST | Under Section 14 of IGST Act, foreign suppliers must register and pay GST when supplying to unregistered individuals |

| 2. B2B | XYZ Ltd (GST-registered Indian company) buys cloud storage from CloudCo (US-based) | XYZ Ltd pays GST under Reverse Charge | B2B imports of services require GST payment by recipient under RCM |

| 3. Platform Intermediary | Google Play Store (foreign platform) aggregates and sells mobile apps and digital content to Indian users | Google Play Store pays IGST | Platforms like Google Play that facilitate supply, collect payment, and control delivery are treated as deemed suppliers under GST law and must pay IGST. |

| 4. Freelancer (Registered) | Ankita, a GST-registered freelancer, buys design templates from SkillStream (Canada) | Ankita pays GST under RCM | B2B rule applies — registered recipients pay GST on imported digital services |

| 5. Free Services | CloudSync Ltd. (USA) offers 6 months free cloud storage to Indian users | No GST (if truly free) | No consideration = no supply under GST; but conditions apply if bundled/charged later or supplied to Related Person |

| 6. Indian Branch Office | MusicPro (US-based) opens a branch in India and offers streaming services | Indian branch collects & pays GST | Once a branch exists in India, it is treated as a local supplier under GST law |

If you are a non-resident online service provider delivering digital services (like e-learning, cloud storage, streaming, etc.) to unregistered users in India, you must register under GST, irrespective of turnover.

Applicable under Section 14 of the IGST Act.

GST Registration must be done using Form GST REG-10

Registered OIDAR service providers are required to file:

GSTR-5A (Monthly Return for Online Information and Database Access or Retrieval services by non-residents).

This must be filed on or before the 20th of the following month.

Once registered under GST for OIDAR services, you must:

Once registered under GST for OIDAR services, you must:

Applies even to foreign suppliers via Indian representatives.

Make your OIDAR registration simple with 4 quick steps!

Fill the Form

Talk To Expert

Submit Your Documents

Get Registration Done

Whether you're in Berlin or Boston, we help you stay GST-compliant in India—without setting foot here.

Forget Indian bureaucracy nightmares. We’ll get you registered as a Non-Resident OIDAR provider—no Indian address? no problem.

We’ll ensure your returns are filed before the 20th of every month. You focus on scaling; we’ll handle the spreadsheets

No need to chase someone in Delhi—our team acts as your official point of contact with the Indian tax departmen

We’ll help you generate compliant invoices and guide you on how to charge and remit IGST correctly.

No more guessing games. We make sure you’re 100% compliant, so you never see a surprise ₹10,000 fine in your inbox

We stay with you beyond registration—filing returns, sending reminders, and keeping you updated on every OIDAR-related change that matters.

Move your business forward with our expert Financial Models!

10+ years of experience with 125+ experts guiding you every step of the way.

All-inclusive pricing with no hidden fees.

Using tech to provide great service to customers everywhere.

From documents to compliance, we handle it all.

Join a large community of successful businesses.

We’ve helped startups grow into billion-dollar businesses.

Discover why businesses love working with Startup Movers!

Really happy with the professional way in which the work has been done (y). Worked with other CA’s previously, Startup movers were the best one- whom we worked with

Excellent service at affordable prices. They are very punctual and work really hard to get the job done.

These guys are really good particularly their secretarial part. Very professional very prompt.

Excellent!!…. Excellent!..

Startup Movers helped us with our

company incorporation & re-correction was done quickly and everything that goes with it has done

good.

The best part about working with StartUp Movers is that they understand the DNA of a startup very well, and are flexible in their approach. This makes them very compatible partners for any start-up.

I have had great experience with Shivani. Right now the only structured department in my organisation is Finance, grateful to the team of startup movers.

These guys are very professional and perfect in their areas of expertise. They know their customers’ pain point very well. From company registration to compliances, they have delivered the best. For an early stage startup, these guys act as a “Virtual CFO”.

Working with the Startup Movers team has been extremely great in all aspects. These guys are the best at the best affordable prices in the market.

We wanted to setup employee benefit plans such as ESOP for our startup and startup movers team were the perfect fit to do those policy drafting and helping with the correct statutory filing. They have framed the policy as a perfect fit for our requirement and in very timely manner.

Since the start of my entrepreneurship journey, Start-up Movers have been managing our Secretarial Compliance (including fundraising compliances), and financial compliance (such as GST, TDS, PF/ ESI, PT) The team has been phenomenal. They are well-versed with all MCA rules and regulations.

Need answers? Browse our FAQs for quick guidance!

In the case of OIDAR services, when provided by a supplier located outside India to an unregistered individual (B2C) in India, the foreign supplier is liable to pay GST. This ensures tax parity between foreign and Indian digital service providers.

Yes, OIDAR registration is mandatory under GST for foreign service providers supplying digital services to unregistered individuals (B2C) in India. In this case, the foreign supplier is liable to pay GST under the normal charge mechanism, and must obtain GST registration in India—irrespective of turnover.

However, if the OIDAR services are supplied to registered businesses in India (B2B), then the Reverse Charge Mechanism (RCM) applies. In such cases, the Indian recipient is liable to pay GST, and the foreign supplier does not need to register.

The primary difference lies in what is being sold and how the service is delivered:

Yes, in B2B cases (where the Indian recipient is registered under GST), RCM on OIDAR services applies.

The recipient in India must pay GST under the Reverse Charge Mechanism.

The OIDAR services GST rate is 18%, which applies to most digital and online services provided under this category.

No, TDS on OIDAR services does not typically apply when services are provided by a non-resident without a physical presence in India.

However, businesses should evaluate case-by-case based on how payments are structured.