The Softex Form is a mandatory regulatory requirement for companies in India that export software and IT-enabled services (ITES).

It must be filed with the Reserve Bank of India (RBI) through authorized officials at Software Technology Parks of India (STPI) or SEZ Development Commissioners.

Softex Filings record every software export, whether delivered physically or online and ensure that foreign exchange earnings are tracked and regulated under FEMA guidelines.

Discover the key benefits of Softex Filings, from compliance to credibility.

Stay aligned with regulatory requirements and avoid compliance risks.

Acts as official evidence of foreign exchange earned by IT/ITES companies.

Timely filing prevents penalties, notices, and compliance gaps.

Ensures transparent reporting of export payments received in India

Essential for startups planning fundraising, investment, or expansion.

Provides credibility during due diligence for investors and funding rounds.

Send Invoices. Get Softex. Done.

Collect Your Data

Prepare & Verify Forms

File & Support

No documents, no filing; here’s what you need

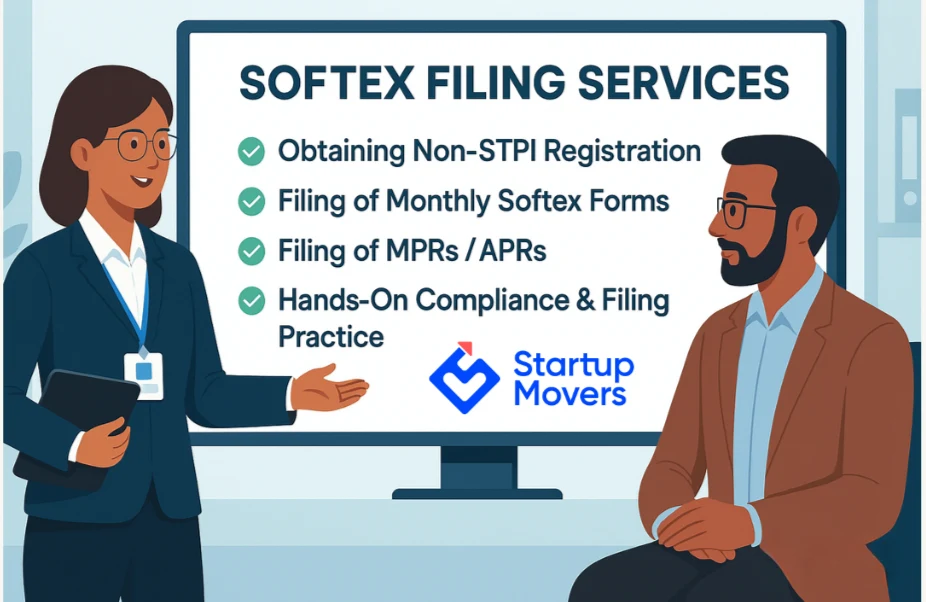

Complete Softex support, from setup to submission

Not registered with STPI? We help you obtain Non-STPI registration so your company can start filing Softex forms seamlessly.

We manage the complete Softex Form Filing process; preparing, verifying, and submitting forms on time every month to ensure RBI/STPI compliance.

Our experts file Monthly Progress Reports (MPRs) and Annual Performance Reports (APRs) accurately, so you stay fully compliant with STPI and RBI regulations

We provide end-to-end assistance in responding to RBI or STPI queries related to Softex submissions, ensuring smooth compliance even during scrutiny.

Clarity in process. Confidence in outcome.

We begin by understanding your business model; IT/ITES services, STPI/SEZ status, and export process to map your Softex filing needs.

Whether you need Non-STPI registration or documentation with SEZ/STPI, our experts handle the entire setup so you’re ready to file.

From invoices to FIRCs and agreements, we collect and verify all required documents to ensure zero rejections at the Softex stage.

We prepare and file monthly Softex Forms, MPRs, and APRs accurately, following RBI/STPI formats for smooth approvals.

Got an RBI or STPI query? Our team responds with clarity, managing compliance queries and ensuring your filings are never stuck.

We don’t stop at filing, continuous tracking of foreign exchange inflows, law updates, and compliance reminders keep your business audit-ready.

Count on Startup Movers as your trusted GST Strategic Partner!

10+ years of experience with 125+ experts guiding you every step of the way.

All-inclusive pricing with no hidden fees.

Using tech to provide great service to customers everywhere.

From documents to compliance, we handle it all.

Join a large community of successful businesses.

We’ve helped startups grow into billion-dollar businesses.

Discover why businesses love working with Startup Movers!

Really happy with the professional way in which the work has been done (y). Worked with other CA’s previously, Startup movers were the best one- whom we worked with

Excellent service at affordable prices. They are very punctual and work really hard to get the job done.

These guys are really good particularly their secretarial part. Very professional very prompt.

Excellent!!…. Excellent!..

Startup Movers helped us with our

company incorporation & re-correction was done quickly and everything that goes with it has done

good.

The best part about working with StartUp Movers is that they understand the DNA of a startup very well, and are flexible in their approach. This makes them very compatible partners for any start-up.

I have had great experience with Shivani. Right now the only structured department in my organisation is Finance, grateful to the team of startup movers.

These guys are very professional and perfect in their areas of expertise. They know their customers’ pain point very well. From company registration to compliances, they have delivered the best. For an early stage startup, these guys act as a “Virtual CFO”.

Working with the Startup Movers team has been extremely great in all aspects. These guys are the best at the best affordable prices in the market.

We wanted to setup employee benefit plans such as ESOP for our startup and startup movers team were the perfect fit to do those policy drafting and helping with the correct statutory filing. They have framed the policy as a perfect fit for our requirement and in very timely manner.

Since the start of my entrepreneurship journey, Start-up Movers have been managing our Secretarial Compliance (including fundraising compliances), and financial compliance (such as GST, TDS, PF/ ESI, PT) The team has been phenomenal. They are well-versed with all MCA rules and regulations.

Need answers? Browse our FAQs for quick guidance!

All software exporters in India whether registered under STPI, SEZ, or as Non-STPI units must file Softex Forms if they provide IT services, SaaS, BPO, KPO, or software products to foreign clients and receive foreign exchange.

Non-filing or delayed filing of Softex Forms can lead to FEMA penalties, difficulty in tracking forex remittances, and problems during RBI scrutiny, audits, or funding due diligence.

Yes, Even companies that are not STPI registered must obtain Non-STPI registration and then file Softex Forms to remain compliant with RBI guidelines.

Common documents include:

Most companies are required to file monthly Softex Forms along with MPRs (Monthly Progress Reports) and APRs (Annual Performance Reports), depending on their export volumes and STPI/SEZ requirements.

The Softex Filing process typically involves: